Bankruptcy Attorney Near Me Can Be Fun For Everyone

Wiki Article

Some Known Facts About Bankruptcy Bill.

Table of ContentsThings about Bankruptcy CourtOur Bankruptcy Information StatementsFacts About Bankruptcy Court UncoveredBankruptcy Benefits for BeginnersBankruptcy Court - TruthsThe Definitive Guide for Bankruptcy Attorney

Phase 13 is typically preferable to chapter 7 since it enables the debtor to maintain an important possession, such as a house as well as enables the debtor to suggest a "plan" to pay back lenders over time typically 3-5 years. Phase 13 is also used by customer debtors that do not get phase 7 relief under the ways test.Phase 13 is really various from chapter 7 considering that the phase 13 borrower usually stays in property of the building of the estate as well as pays to financial institutions, through the trustee, based on the debtor's expected revenue over the life of the strategy. Unlike chapter 7, the debtor does not obtain an instant discharge of financial debts.

This magazine reviews the applicability of Phase 15 where a debtor or its building undergoes the regulations of the USA as well as one or more foreign nations. To find out more regarding filing personal bankruptcy, call our workplaces today. Our skilled team can aid you obtain a financial debt totally free fresh start.

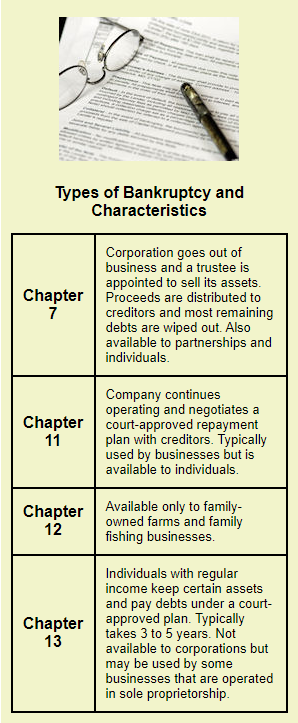

Insolvency Regulation in the United States is Federal Legislation under Title 11 of the United States Code. Those are real chapters "in the publication" of the Bankruptcy Code, as well as each Phase affords one-of-a-kind provisions.

All About Bankruptcy Lawyers Near Me

In a corporate atmosphere, a Chapter 7 insolvency is a liquidation. In an individual Chapter 7 personal bankruptcy, there is no liquidation of the individual.

There is no minimum quantity of financial obligation required in order to be qualified to file for Insolvency. All debt has to be provided on an Insolvency petition.

If you took a lending to acquire an automobile and can not make your month-to-month repayments, your vehicle might be repossessed by the lender. An usual period to be worried regarding repossession would certainly be 45-75 days misbehavior. There are a number of

Fascination About Bankruptcy Australia

Also if you have nondischargeable financial obligation, insolvency might still be a choice.Your state lists the products insolvency filers can safeguard in its personal bankruptcy exemption legislations, although some states allow filers use the government personal bankruptcy exemptions if they would certainly shield much more home. (You have to choose one listing or the otheryou can not use exceptions from both lists.) You'll utilize the very same exemptions in both Chapters 7 and also 13.

In Chapter 7, you would certainly lose the nonexempt property, as well as the trustee assigned to manage your case would sell it and offer the profits to your lenders. In Phase 13, you do not shed nonexempt home. Rather, you need to pay financial institutions what it deserves via the settlement strategy. Testimonial your state's bankruptcy exemptions to get a feel for the residential or commercial property you 'd keep (state links are at all-time low).

For the many part, businesses do not file for Phase 7 or 13. Rather, think about Chapter 11 or Phase 11 subchapter V for tiny businesses.

Some Of Bankruptcy Attorney

Getting approved for Chapter 13 isn't ever read what he said before straightforward, as well as due to the various complex rules, you'll wish to collaborate with an insolvency attorney. Until then, you can find out regarding the Chapter 13 settlement strategy and obtain a concept about whether you make adequate earnings to cover what you'll have to pay.It's not excellent, however it will certainly reveal you what you must pay (you could need to pay more). Not long after you file your "petition" or personal bankruptcy documents, calls, letters, wage garnishments, and also collection suits should come to a stop. It occurs as a result of the "automatic remain" order the court promptly established.

At the conference, the trustee will inspect your recognition and ask concerns concerning your filing - bankruptcy bill. Financial institutions can appear and also ask inquiries also, however they seldom do.

Generally, after one year you will be discharged from bankruptcy and all of your financial debts will be composed off. Insolvency bargains with both secured and also unprotected debt.

All about Bankruptcy

In some circumstances, the High Court can make you bankrupt at the demand of a financial institution. A creditor can seek for bankruptcy against you if you have actually committed an act of bankruptcy within the previous 3 months.

As soon as your insolvency begins, you are without financial obligation. The Authorities Assignee now has your properties and administers your estate. Your financial institutions can no more seek repayment straight from you. They must deal directly with the Authorities Assignee and all communication need to be forwarded to him. You should add any kind of excess income to the Official Assignee.

Any individual can examine this register. Review extra in the ISI overview After you are made insolvent (pdf). The Authorities Assignee will certainly discuss a Revenue Settlement Arrangement or look for a Revenue Payment Order for the excess of your revenue over the practical living expenditures for your scenario, based on the ISI's standards.

Our Bankruptcy Australia Ideas

If you get assets after the date when you are made bankrupt (for example, with inheritance) the Authorities Assignee can declare them as well as market them for the benefit of your financial institutions. If click over here now you own a family home, by yourself or with another individual, the Authorities Assignee may only sell it with the previous approval of the court.If you hold home jointly (for example, with your partner) your click to read insolvency will cause the joint possession to be divided in between the Authorities Assignee as well as your non-bankrupt co-owner. If the Official Assignee has not marketed your house within 3 years, ownership might instantly move back to you, unless otherwise agreed.

Report this wiki page